The oil and gas industry plays an integral role in the economy of Wyoming. Here you will find the latest oil and gas facts and figures from Wyoming, including development, taxes, employment and more. For more information on oil and gas development in general, as well as in Wyoming, visit our Oil and Gas 101 page.

EXPLORATION

The petroleum industry has been exploring for oil and gas in Wyoming for 140 years. In 1884 the first oil well was drilled southeast of present day Lander.

The deepest vertical well drilled in Wyoming to date is a 25,830 ft gas well in the Madden Formation near Lost Cabin, Wyoming. With the development of horizontal drilling well depth is measured differently with both True Vertical Depth (TVD) and Measured Depth (MD). TVP is the depth below the surface while MD is the total length of the well bore including vertical and lateral depth. The longest permitted well in Wyoming to date is just over 40,000 feet in MD.

PRODUCTION

Nationally, Wyoming ranked 8th in production of both crude oil and natural gas in 2022. Wyoming also ranked the 2nd largest producer of both oil and natural gas on federal lands, making the state disproportionally affected by national policy changes.

At its peak, Wyoming had 27,951 producing wells in 2022 including 10,120 producing oil wells and 17,800 producing gas wells.

Wyoming had 33 operating gas plants in 2022 processing nearly 97% of the state’s gas production.

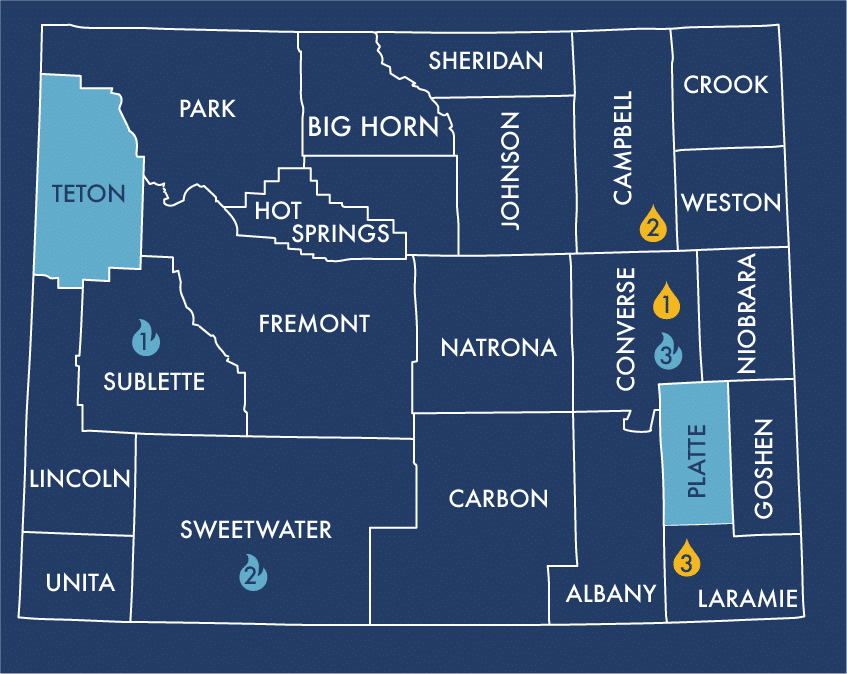

Twenty-one of Wyoming’s 23 counties produce oil and/or natural gas. Teton and Platte Counties are the only two counties without active production. Converse County continues to lead crude oil production in the state followed by Campbell and Laramie Counties at number 2 and number 3 respectively. Sublette County tops natural gas production in the state once again while Sweetwater and Converse Counties follow up in second and third.

Percentage of Wyoming Oil Production by Company (2023)

Percentage of Wyoming Gas Production by Company (2023)

Percentage production by company data provided by the Wyoming Oil and Gas Conservation Commission and compiled by the Wyoming State Geological Survey

REFINING AND TRANSPORTATION

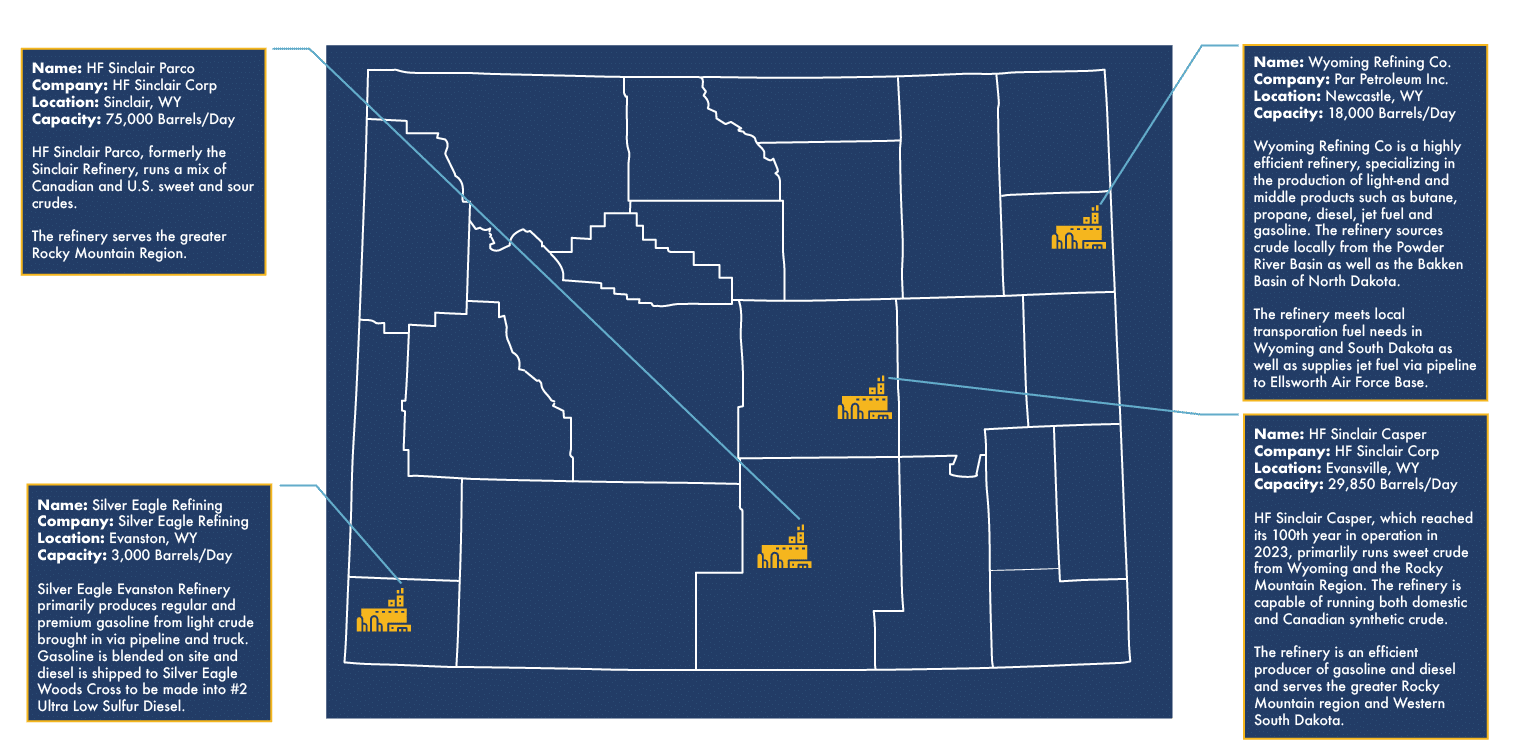

Wyoming’s first refinery was constructed in Casper in 1895. In 2022 there were 4 operating refineries in the state with a capacity to refine 125,850 barrels of crude oil each day. In 1981 there were 14 active refineries in the state. Below is a map of Wyoming’s refineries and what they produce, supply sources and areas they serve. Thank you to the American Fuel & Petrochemical Manufactures for the information.

According to the Energy Information Agency, Wyoming produces nearly 12 times the amount of energy it consumes making it the second-largest net exporter of energy after Texas. Getting Wyoming’s resources to consumer takes significant infrastructure including pipelines.

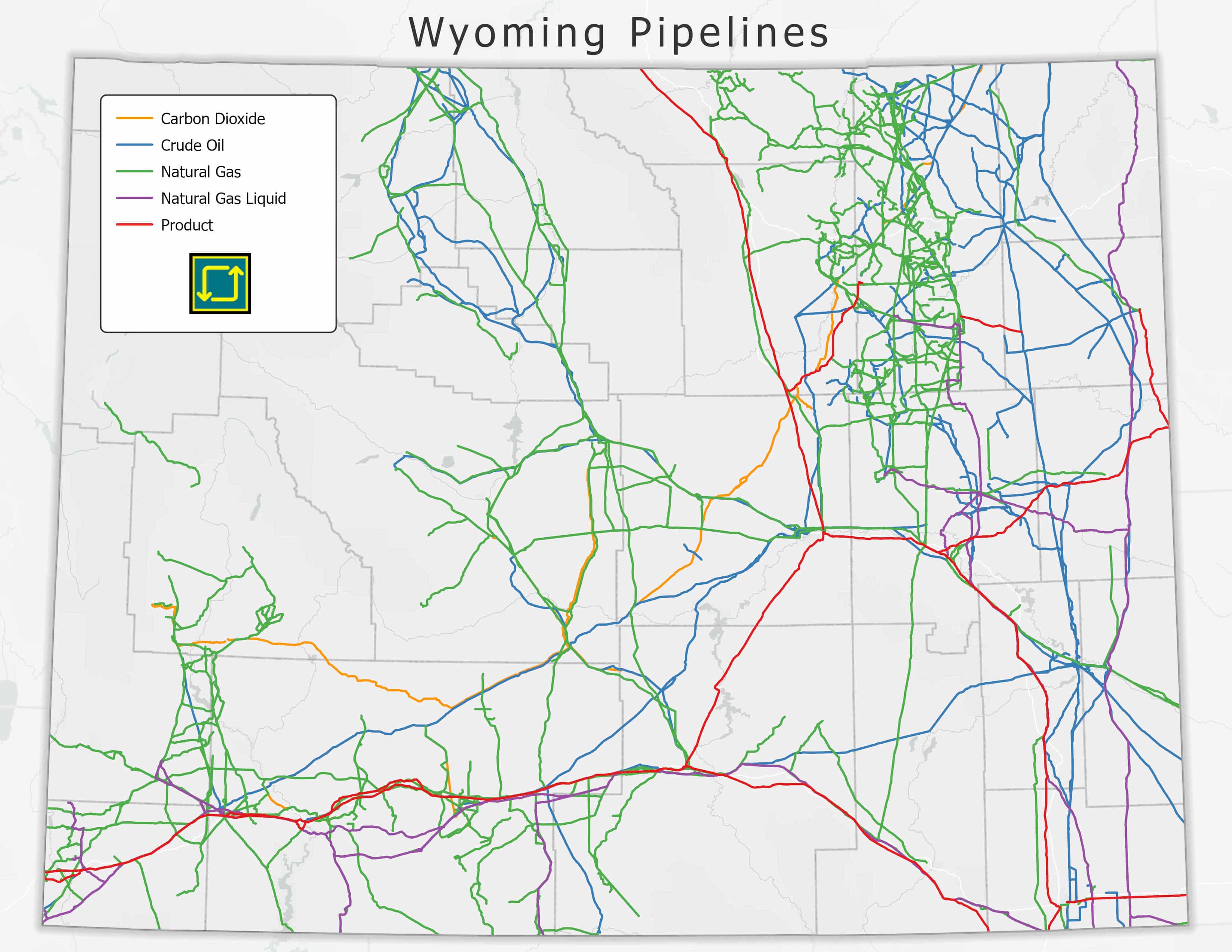

The first crude oil pipeline was constructed in 1911. Today, there are approximately 100 companies operating more than 25,000 miles of pipelines in Wyoming, not including all gathering systems or all inactive or abandoned pipelines. Pipelines are located in all of Wyoming’s 23 counties and carry crude, natural gas, natural gas liquids, carbon dioxide and petroleum products. The map below, provided by the Enhanced Oil Recovery Institute, gives an overview of the pipeline infrastructure in Wyoming.

PROPERTY TAXES

Oil and gas production, by itself, accounted for over 40% of the total property taxes levied in Wyoming and approximately 80% of the property taxes levied on all minerals.

Property taxes levied – 2022 Mineral Production

| Crude Oil | $485,844,982 |

| Natural Gas | $393,975,948 |

| Oil and Gas Total | $879,820,930 |

| Coal | $166,969,468 |

| Trona | $37,072,564 |

| All Others | $9,079,352 |

| Total All Minerals | $1,092,942,314 |

| TOTAL All-State Property Taxies Levied | $2,199,769,606 |

Minerals as a Percentage of Property Taxes

Minerals are the only class or kind of property in Wyoming valued and taxed at 100% of their actual value. Minerals are also the only class or kind of property which pay two direct taxes (property and severance).

SEVERANCE TAXES

Crude oil and natural gas production paid over $274 million in severance taxes, about 59% of all the severance taxes paid by minerals produced in 2020.

Severance Taxes – 2022 Production

| Crude Oil | $460,068,045 | ||

| Natural Gas | $375,365,837 | ||

| Oil and Gas Total | $835,433,882 | ||

| Coal | $185,826,137 | ||

| Trona | $22,653,914 | ||

| All Others | $2,754,669 | ||

| Total All Minerals | $1,046,668,602 |

Percentage of Severance Taxes Collected

ROYALTIES

In addition to property and severance taxes, Wyoming collects a royalty for petroleum produced on state-owned lands along with certain fees and rentals. The state also receives one-half of the royalties paid to the federal government for leasing, production, and fees on federal lands. Typically, the royalty rate on state leases is 16 2/3%. On federal lands, the rate is 12 1/2%.

RESERVES

According to the EIA, at the end of 2021, Wyoming had 978 million barrels of crude oil reserves, or 2.4% of the U.S. reserves. Additionally, Wyoming had 15,005 billion cu ft of dry natural gas reserves, 2.5% of U.S. reserves, and 563 million barrels of natural gas plant liquids, 2.2% of U.S. reserves.

GENERAL

According to a 2023 study released by the American Petroleum Institute, in 2021 the oil and natural gas had the following impacts on the Wyoming economy:

58,780 Total Jobs

$5.7 Billion in Labor Income

Gross Domestic Product (GDP) by Industry (in millions)

According to the Bureau of Economic Analysis Wyoming’s top three industries by GDP are Oil and Natural Gas Production, Tourism and Agriculture.

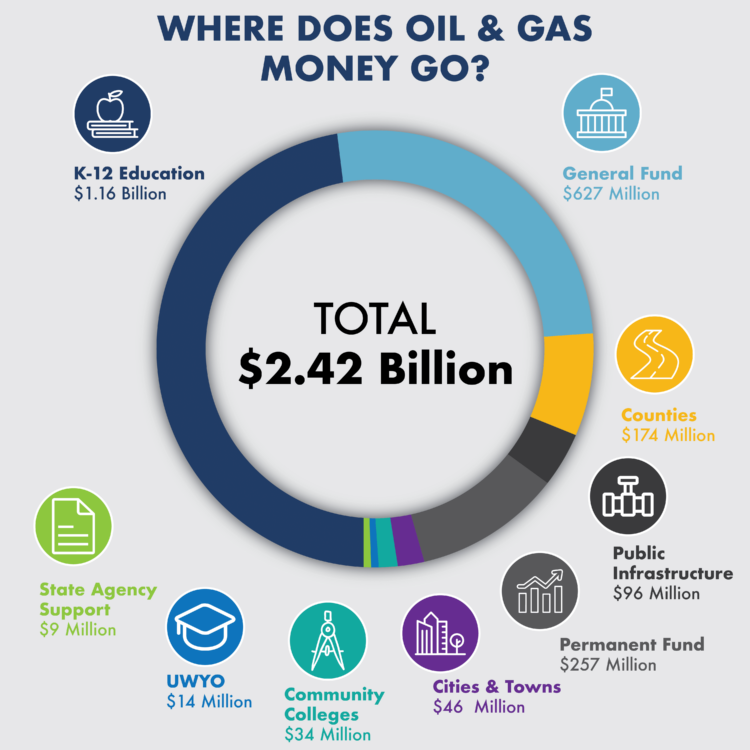

In fiscal year 2023 oil and gas production contributed the following to state and local governments:

Historic Contributions to the State (in billions)

The oil and natural gas industry has provided more than $11 billion to the state of Wyoming for education, infrastructure, government operations and more over the last six years. In 2023 alone, the industry’s contributions equated to approximately $4,143.43 in direct payments to the state for every Wyoming resident – helping keep individual taxpayers’ burdens lower than many other states.

All data obtained from the State of Wyoming and/or federal agencies.

Currently, a 6% severance tax rate applies to crude oil and natural gas production (4% on stripper). Severance tax revenues are distributed to a variety of funds including: General Fund, Permanent Mineral Trust Fund, schools, cities, towns, highways, counties and water development.